Divide and Conquer Your Budget: How to Manage that Key 50%

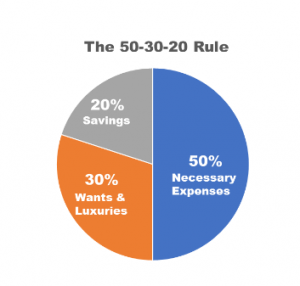

You know what you earn each paycheck. Do you know how much you allot for necessary expenses? As a financial advisor, we live by the “50-30-20 rule” (see Figure): 50% of your income should be spent on necessary expenses, 30% on things you desire but don’t actually need, and the remaining 20% should go to savings. For this post, we’ll focus on that largest percent, on which the other calculations depend: You should pay no more than half of your earnings on the necessities of life, like your mortgage or housing costs, utilities, transportation and health care expenses, basic clothing needs, and food. This is a standard for “living within your means.”

It’s a rather simple calculation. This 50% figure refers to your earnings after taxes but before any deductions, such as retirement contributions or health care premiums. Let’s say your gross salary is $6,000 per month. After federal, state, and social security taxes are removed, that may leave you with $5,000 per month. You additionally have $400 per month automatically removed for health care premiums, but we want to consider the total before the deduction is made. The 50% rule means you should be spending no more $2,500 on those necessary expenses today.

What is the major implication of this? You’ll have the other 50% to spend on the niceties of life (like going to a ballgame, eating at a nice restaurant, vacationing, and buying that big-screen TV) and growing your wealth.

If you are living within your means, you will also have ample money to spend on your living priorities and to put away in savings or in an account for emergencies, like replacing your water heater. Another way to utilize this non-essential 50% is to pay down your debt more rapidly.

The first priority: Know where you stand on the money you need to spend.

Sometimes, it can be tricky to determine what is a necessity and what is simply something you desire. Could you live without an item? Then it is not a necessity. That subscription to HBO may seem really important, but it is not a necessity! However, that may be something you believe is more essential than buying a second bottle of wine. You can prioritize the things you want, but not the expenses you have to pay.

However, it all starts with getting a firm grip on the money you earn and how much of it goes towards your most essential expenses.

At Isakov Planning Group, we help people understand their budgets, which has direct impacts on how much they put towards savings and other discretionary spending. It all starts with a free consultation. Contact the experts at Isakov Planning Group today!